Global geopolitical tensions, macroeconomic developments and climate change are resulting in heightened demand for risk protection warns Swiss Re, outlining possible implications for renewals season. It said the re/insurance industry needs to focus on modelling and contract certainty to ensure pricing is adequate for the risks taken and thereby increasing its capacity.

Geopolitical tensions, inflationary pressures and knock-on effects such as energy shocks, cyber threats and supply chain disruptions continue to pose challenges for society and ultimately the re/insurance industry. In addition, the reinsurer warns that climate change is increasingly manifesting itself with no end in sight.

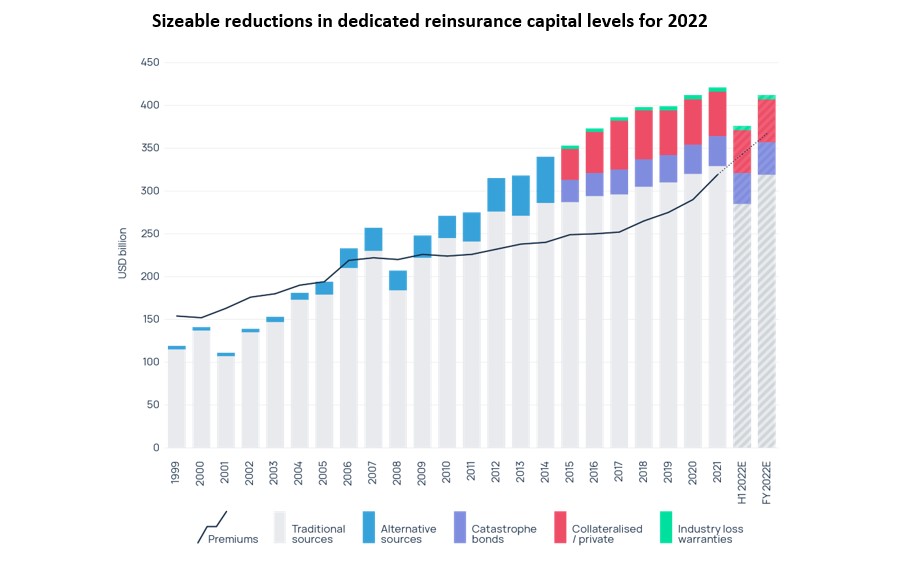

However, it does point to significant opportunities to hedge this volatile environment with insurance solutions. Increased risk awareness and exposures will result in more demand for insurance protection across all businesses and regions, translating into a positive outlook for premiums. Swiss Re Institute expects a US$33bn increase in commercial premium volumes in the period from 2022 to 2026 as a result of supply chain reshoring. In addition, if countries deliver on building all the renewable energy capacity that they have so far targeted, investments in green energy are expected to generate additional energy-sector related premiums of US$237bn by 2035.

Moses Ojeisekhoba, Swiss Re’s CEO, Reinsurance, said: “On top of impacts from Covid-19 and increasing losses from natural catastrophes, the re/insurance industry is now confronted with issues like inflation, risk of recession and geopolitical tensions. We have proven our resilience by supporting clients and society throughout the last years by paying large insurance claims. As we see cost drivers accelerating in this dynamic risk environment, insurance premiums must be carefully calibrated to keep pace.”

The natural catastrophe re/insurance market is forecast to grow to about US$48bn over the next four years from US$35bn according to Swiss Re Institute. Swiss Re says the market needs to keep up with growing loss trends and develop modelling capabilities for weather-related risks such as secondary perils, pointing to its own proprietary models and natural catastrophe research team of 50 natural scientists and engineers as an example of the kind of resources needed.

Thierry Léger, Swiss Re’s group CUO, added: “To enable the insurance industry to keep up with increasing demand, three factors will be key: evaluating and modelling the evolving trends; ensuring a shared understanding of contractual terms; and generating improved technical margins to reflect the effective risk.”

Printed Copy:

Would you also like to receive CIR Magazine in print?

Data Use:

We will also send you our free daily email newsletters and other relevant communications, which you can opt out of at any time. Thank you.

YOU MIGHT ALSO LIKE