Some 418 mergers and acquisitions completed worldwide in the insurance market throghout 2021, up from 407 the previous year.

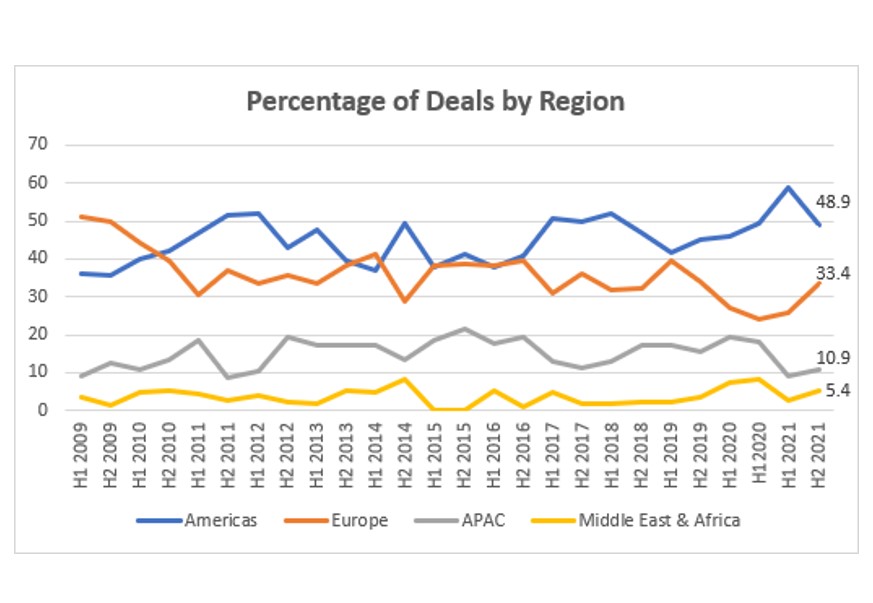

Driven by a particularly strong second half, which saw 221 deals, up from 197 in the first six months, the Americas remained the most active region, according to figures released today by law firm Clyde & Co.

Deal activity in Europe was up 21% year-on-year, buoyed by a stand-out second half, which saw 74 transactions, up from 51 in H1 2021.

Following two buoyant years, Asia-Pacific saw a 44% drop in activity from 75 deals in 2020 down to 42 in 2021. The Middle East & Africa also experienced a similar trend, with the 2021 total of 17 deals representing a 47% decrease on 2020, which was a bumper year for the region with 32 transactions.

Ivor Edwards, head of Clyde & Co's European Corporate Insurance Group, said: “As anticipated, the volume of insurance M&A activity worldwide picked up notably in 2021. Despite the pandemic continuing to shape the economic and political landscape, investor sentiment strengthened in most regions as re/insurers rode the wave of rising prices across all product lines to generate healthy top line growth. Signs that market hardening is slowing down in certain classes, combined with the pressure of rising costs means that for those businesses looking to expand, the decision on whether to grow through acquisition or by building out existing operations has never been more relevant.”

Printed Copy:

Would you also like to receive CIR Magazine in print?

Data Use:

We will also send you our free daily email newsletters and other relevant communications, which you can opt out of at any time. Thank you.

YOU MIGHT ALSO LIKE